The Role of Parametric Insurance in Climate-Exposed Economies: Is Sri Lanka Ready?

As climate risks intensify worldwide, traditional insurance models are being evaluated for their speed and effectiveness in high-risk regions. For countries like Sri Lanka, where climate change manifests in the form of floods, droughts, and landslides, there is an urgent need for innovative insurance mechanisms that can offer fast, transparent, and scalable protection. One such innovation gaining traction is parametric insurance.

Read More : https://www.linkedin.com/pulse/parametric-insurance-game-changer-raichel-suseel

What Is Parametric Insurance?

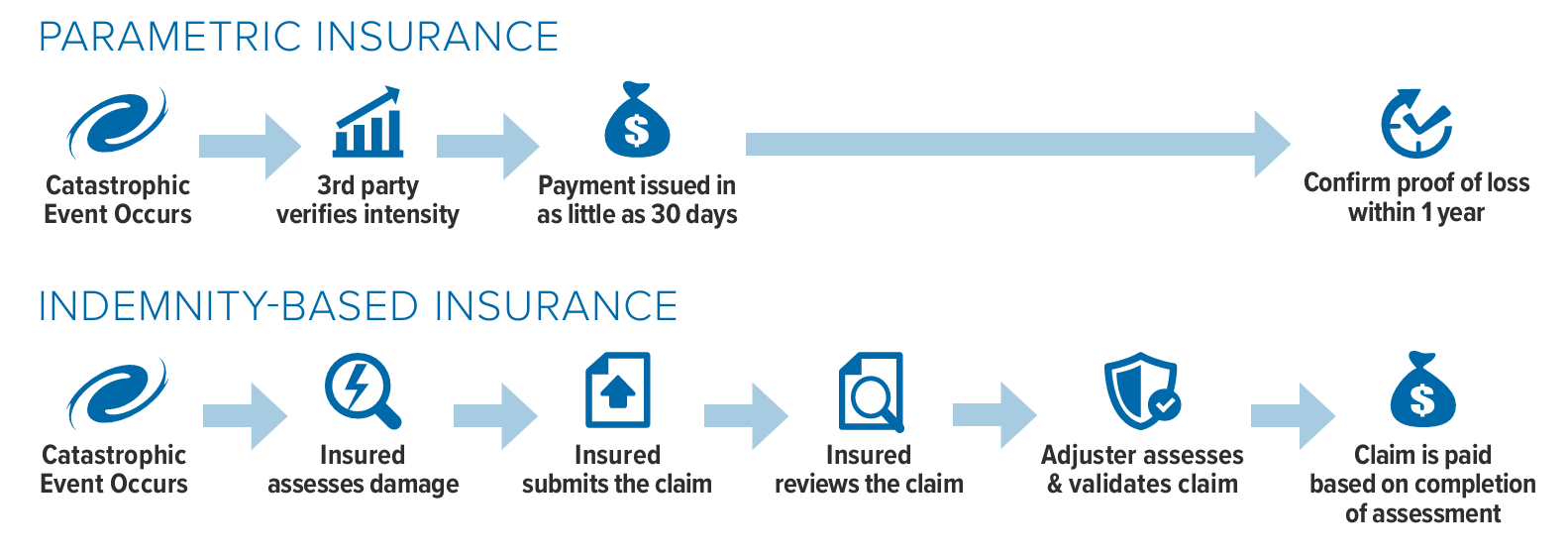

Parametric insurance differs from traditional indemnity insurance in one key way: it pays out based on a predefined trigger event, such as a specific amount of rainfall, wind speed, or seismic activity, rather than after assessing the actual loss.

For example, if rainfall exceeds 200 mm within a specific time frame, the insured party receives a fixed payout, regardless of actual damage. This model eliminates the lengthy claims adjustment process, speeding up the delivery of relief to those affected.

Why Parametric Insurance Matters in Climate-Exposed Economies

Countries vulnerable to extreme weather events often face:

- Delayed claims processing due to infrastructure damage or overwhelmed systems.

- Underinsurance among rural communities and small businesses.

- Financial instability often follows disasters, particularly in economies heavily reliant on agriculture and tourism.

Parametric insurance offers a solution that is:

✅ Fast – Payouts can be made in days, not months.

✅ Transparent – Trigger conditions are clear and measurable.

✅ Efficient – Reduces administrative burden for both insurers and policyholders.

✅ Inclusive – Can cover vulnerable populations that may not have access to traditional products.

Sri Lanka’s Climate Risk Profile: A Call to Action

Sri Lanka ranks among the countries most exposed to climate risks in Asia. According to global climate indices, the country has seen an increase in:

- Floods (especially in urban and plantation areas)

- Droughts (impacting rice, tea, and coconut farmers)

- Cyclones and sea-level rise (affecting coastal livelihoods)

These recurring events have put pressure on national relief funds and insurance frameworks. In this context, parametric solutions could offer:

- Rapid disbursement of aid to affected farmers or fishermen

- Support for microinsurance programs

- Stronger financial resilience for disaster-prone regions

Is Sri Lanka Ready for Parametric Insurance?

Opportunities:

- The growing focus on agritech and climate resilience opens the door for weather-indexed microinsurance.

- Collaborations with global insurance brokers and development finance institutions can bring in the required capital and technical support.

- The Central Bank’s Sustainable Finance Roadmap encourages innovation in climate-related financial services.

Challenges:

- Data availability – Accurate and real-time data (e.g., rainfall, wind speeds) is essential to trigger parametric payouts reliably.

- Awareness and education – Many stakeholders, especially in rural areas, are unfamiliar with how parametric insurance works.

- Regulatory frameworks – The existing insurance regulations may need updates to accommodate non-traditional models.

Global Inspiration: Lessons from Other Economies

Parametric insurance has already proven its potential in:

- Kenya and Ethiopia, through weather-indexed crop insurance for smallholder farmers.

- The Caribbean, with parametric disaster bonds under the Caribbean Catastrophe Risk Insurance Facility (CCRIF).

- India, where government-backed parametric schemes support farmers during monsoon failures.

Sri Lanka can draw from these experiences to design context-specific products that are affordable, sustainable, and scalable.

Final Thoughts

Parametric insurance is not a replacement for traditional insurance, but a powerful complement, especially in countries vulnerable to frequent climate shocks. For Sri Lanka, embracing this model could mean faster recovery times, greater financial resilience, and protection for communities at the frontlines of climate change.

While challenges exist, with the right partnerships, data infrastructure, and regulatory evolution, Sri Lanka has the potential to lead the region in climate-smart insurance solutions.

2 Comments

Great article! Securing reliable Environmental Risk Insurance in Australia is increasingly important for businesses exposed to pollution, waste, or environmental liabilities. Whether you’re in manufacturing, construction, or energy, a strong policy helps manage legal and cleanup costs while supporting regulatory compliance. It’s a critical safeguard in today’s environmentally conscious landscape. Thanks for sharing these valuable insights!

Great article! Exploring Parametric Insurance Solutions is essential for businesses seeking fast, transparent, and efficient risk coverage. Unlike traditional insurance, parametric policies pay out based on predefined triggers such as weather events or seismic activity allowing for quicker recovery and reduced administrative burden. This innovative approach provides financial resilience and peace of mind in uncertain conditions. Thanks for sharing these valuable insights!