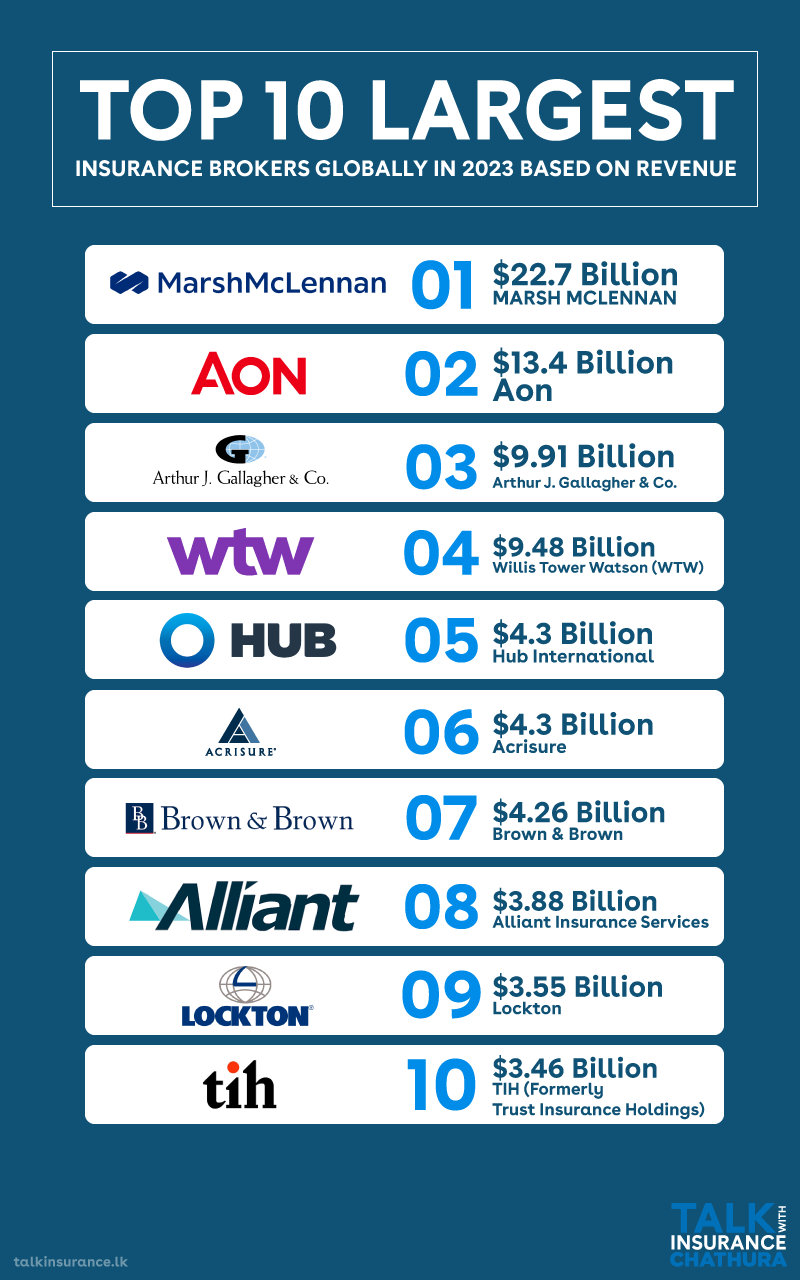

In 2024, the global insurance industry is dominated by some of the largest insurance brokers based on revenue. Here are the top 10 players:

1. Marsh McLennan – $22.7 billion

2. Aon – $13.4 billion

3. Arthur J. Gallagher & Co. – $9.91 billion

4. Willis Towers Watson (WTW) – $9.48 billion

5. Hub International – $4.3 billion

6. Acrisure – $4.3 billion

7. Brown & Brown – $4.26 billion

8. Alliant Insurance Services – $3.88 billion

9. Lockton – $3.55 billion

10. TIH (formerly Truist Insurance Holdings) – $3.46 billion

These industry leaders, such as Marsh McLennan, Aon, and Gallagher, are not only the largest in size but also hold significant influence. Marsh McLennan has consistently secured the top position, with Aon and Gallagher following closely behind. Gallagher’s rapid growth can be attributed to its strategic acquisitions. Sources for this data include Insurance Business America and Disfold.

Marsh McLennan: The Undisputed Leader

With an astounding revenue of $22.7 billion, Marsh McLennan retains its position as the global leader in insurance brokering. Its dominance can be attributed to a combination of strategic acquisitions, innovative risk management solutions, and a robust global presence. Marsh McLennan’s operations span multiple sectors, making it a trusted partner for corporations, governments, and individuals alike.

Aon: A Close Contender

Ranked second with $13.4 billion in revenue, Aon continues to solidify its standing through its expertise in commercial risk solutions, health and retirement benefits, and data-driven decision-making. Aon’s commitment to leveraging technology, particularly in predictive analytics and cyber risk solutions, sets it apart in the competitive landscape.

Arthur J. Gallagher & Co.: Rapid Growth through Strategic Acquisitions

Arthur J. Gallagher & Co. secures the third spot with $9.91 billion in revenue. Known for its aggressive acquisition strategy, Gallagher has expanded its footprint across diverse markets and geographies. This approach has enabled the company to tap into new client bases while enhancing its range of services.

Willis Towers Watson (WTW): A Trusted Name

With $9.48 billion in revenue, Willis Towers Watson remains a key player in the global insurance industry. WTW’s strength lies in its ability to combine actuarial expertise with cutting-edge technology, offering customized solutions to clients ranging from multinational corporations to mid-sized enterprises.

Emerging Leaders and Key Highlights

While the top four companies dominate the industry, the remaining firms are rapidly gaining ground:

- Hub International and Acrisure (both with $4.3 billion) are known for their focus on mid-market businesses and personalized client solutions.

- Brown & Brown ($4.26 billion) stands out for its decentralized operating model, which allows flexibility and responsiveness to client needs.

- Alliant Insurance Services ($3.88 billion) continues to excel in niche markets, including public entities and construction.

- Lockton ($3.55 billion) is celebrated for its client-centric approach and independence as the largest privately held insurance broker globally.

- TIH ($3.46 billion), formerly Truist Insurance Holdings, has rebranded and is strengthening its position through strategic partnerships and innovation.

Industry Trends and Insights

The success of these top players highlights key trends driving the insurance brokering industry in 2024:

- Acquisitions and Consolidations: Companies like Gallagher and Acrisure are leveraging acquisitions to scale rapidly and diversify their portfolios.

- Technology Integration: Firms are increasingly adopting InsurTech solutions to enhance underwriting, claims processing, and customer engagement.

- Focus on Emerging Risks: From climate change to cyber threats, top brokers are addressing evolving risks with tailored products.

- Global Presence with Local Expertise: A commitment to blending global resources with local market knowledge is enabling these firms to meet diverse client needs effectively.

Conclusion

The global insurance industry in 2024 showcases a landscape dominated by well-established giants that continue to innovate and adapt to changing market demands. Companies like Marsh McLennan, Aon, and Gallagher lead the charge, while others like Lockton and Hub International bring unique strengths to the table.

These firms’ unwavering focus on service excellence, strategic growth, and embracing emerging technologies underscores their critical role in a dynamic and evolving industry. As we look ahead, the continued transformation of the insurance sector promises exciting opportunities for brokers and clients alike.

2 Comments

Great insight! Your post was clear, helpful, and added real value to the topic. Looking forward to more content like this.

I just wrote an incredibly long comment but after I clicked submit my comment didn’t show up. well I’m not writing

all that over again. Anyhow, just wanted to say fantastic blog!

Look into my blog: empty tect